September 18, 2025

Read more ...

September 15, 2025

Read more ...

September 8, 2025

The Financial Reporting Council of Nigeria (FRC) reminds Small and Medium-Sized Practitioners (SMPs) of the 60-day grace period granted to regularise their registration and ensure compliance with the Council’s rules. The grace period expires on 25th September 2025.

Non-compliance will attract sanctions in line with the Council’s operational guidelines.

Read more ...

July 28, 2025

The Financial Reporting Council (FRC) of Nigeria has launched the first edition of its journal, the FRC Journal of Financial Reporting and Corporate Governance. The journal was officially launched on 25 July 2025 at its Lagos office with a ceremonial presentation to the Executive Secretary/CEO of FRC, Dr Rabiu Olowo, by the Editor-in-Chief, Prof Suleiman A. S. Aruwa, and other members of the Editorial Board.

The presentation ceremony was attended by distinguished members of the Editorial Board, including Professor Austin Nweze (Enugu State University of Science and Technology), Professor Sehilat Abike Bolarinwa (Lagos State University), Dr. Musa Abdullahi Musa (Nasarawa State University), and Dr. Abubakar Razaq Garba (FRC). Also present were members of FRC’s management team, as well as the Chief Executive Officer of the Financial Reporting Oversight Board, Gambia, Suleiman Fode, who was visiting on a study tour.

The journal aims to deepen academic scholarship, stimulate policy discussion, and improve professional practice across financial reporting, auditing, assurance, valuation, and corporate governance both within Nigeria and internationally. It is envisioned as a scholarly repository and a strategic platform that promotes transparency, accountability, ethical leadership, and institutional integrity through evidence-based research and thought leadership. This initiative aligns with the Council’s mandate to oversee and enhance education, research, and training in these vital fields.

In his opening remarks, Prof. Aruwa reflected on the significance of the journal and the Editorial Board’s dedication. According to him, “Since our appointment in March 2025, the Board has worked tirelessly to establish governance instruments, editorial policies, peer review guidelines, and submission processes to ensure the journal’s quality and integrity. We received 28 submissions from Nigerian universities; after a rigorous review, 10 articles were accepted and edited for publication, with others undergoing minor revisions. The maiden edition, Volume 1, Number 1, dated June 2025, has been validated for publication today. We have also begun receiving submissions for the second edition scheduled for December 2025.”

He further highlighted plans to enhance the journal’s reach and quality, including the development of an online Journal Management System and the inclusion of associate editors from countries such as Mozambique, Turkey, Ghana, and New Zealand to foster global collaboration and diversify the editorial board. The journal has also applied for ISSN registration for both print and online editions.

Responding on behalf of the FRC, Dr. Rabiu Olowo commended the Editorial Board’s efforts. He stated, “This publication aligns perfectly with our vision and core mandate to promote research, training, and excellence in financial reporting and corporate governance. Over the past years, we have aspired to establish such a platform, and thanks to your commitment, it has become a reality. We pledge our ongoing support to ensure this journal attains international standards and broad accessibility. We encourage further strengthening of the peer review process and welcome the proposal to expand the editorial board with associate editors from recognized institutions globally. We are also considering making the journal openly accessible to remove barriers to quality research.”

The maiden edition includes insightful research articles on earnings quality in agricultural firms, environmental, social, and governance (ESG) disclosures and their influence on investment decisions, the impact of fair value hierarchy on accounting quality in commercial banks, board attributes and human capital disclosure, economic aspects of corporate social responsibility, enterprise risk management across Nigeria, Ghana, and South Africa, and green accounting practices in Nigeria’s oil and gas sector.

The launch of The FRC Journal of Financial Reporting and Corporate Governance marks a milestone in Nigeria’s efforts to enhance the quality and impact of financial reporting and governance research, supporting the country’s broader economic development and institutional transparency goals.

The journal can be accessed via the Council’s website at https://shorturl.at/VRV60

For further information or to contribute to upcoming editions, stakeholders are encouraged to contact the Editorial Board via journal@frcnigeria.gov.ng

Read more ...

March 5, 2026

Invitation to Corporate Governance Compliance Webinar

Read more ...

February 26, 2026

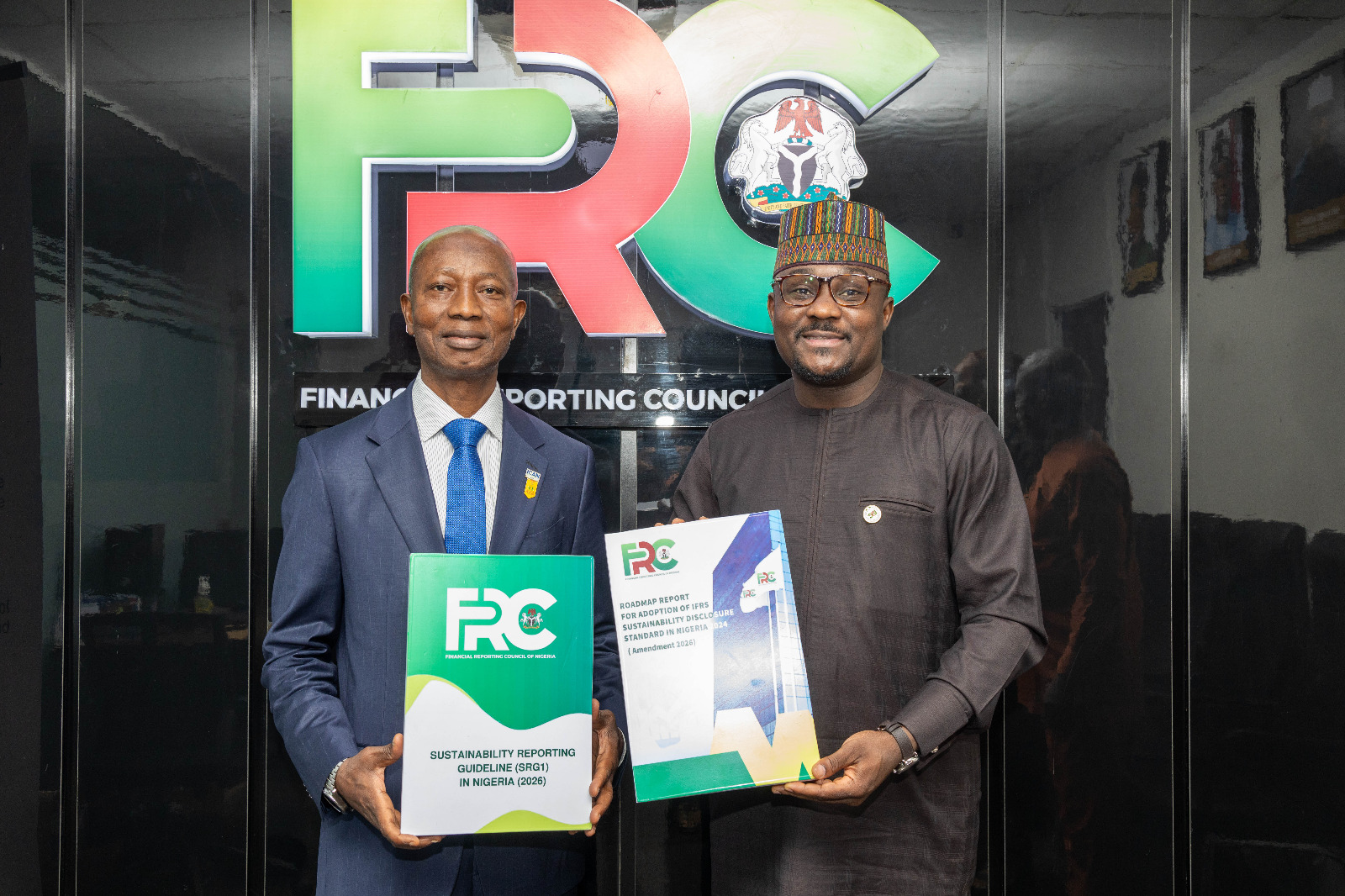

FRC UNVEILS AMENDED ROADMAP AND SUSTAINABILITY REPORTING GUIDELINE TO STRENGTHEN ADOPTION OF IFRS SUSTAINABILITY DISCLOSURE STANDARDS IN NIGERIA

The Financial Reporting Council of Nigeria has unveiled the Roadmap Report for the Adoption of IFRS Sustainability Disclosure Standards in Nigeria 2004 (Amendment 2026) and Sustainability Reporting Guideline 1 (SRG 1) 2026 to provide enhanced clarity and implementation guidance for entities adopting IFRS Sustainability Disclosure Standards, including IFRS S1 and IFRS S2, in Nigeria.

The unveiling took place at the FRC Lagos Office on Monday, 23 February 2026.

The 2026 Amendment updates the Roadmap originally issued in 2024, which positioned 41 Nigerian entities on the verge of full compliance with the ISSB standards, including four early adopters. The update responds to market inquiries and emerging implementation issues. It provides clarity on recent amendments to IFRS S2, reporting timelines, assurance requirements, and the categories of professionals eligible to undertake sustainability reporting for general-purpose financial reporting and corporate reports. The amended Roadmap also clarifies regulatory expectations for adopting entities.

Sustainability Reporting Guideline 1 (SRG 1) 2026 complements the amended Roadmap by providing operational explanations of adoption methodologies. It explains the Adoption Readiness Test Assessment, designed to guide entities in evaluating preparedness for compliance with IFRS Sustainability Disclosure Standards.

The Council followed a structured and transparent process in finalising the documents. Exposure drafts were released in December 2025 with a 21-day public comment period directed at key stakeholders and the general public. The Council collated and reviewed submissions to align recommendations with stakeholder feedback. This was followed by a technical session in Abuja to obtain further expert input before final approval and release on 23 February 2026.

Speaking at the unveiling, the Executive Secretary and Chief Executive Officer of the FRC, Dr. Rabiu Olowo, stated that the updated Roadmap and Sustainability Reporting Guideline became necessary to address areas of concern raised by adopting entities. He noted that the documents provide regulatory clarity and practical guidance to support seamless implementation of IFRS Sustainability Disclosure Standards in Nigeria.

Dignitaries present at the event included:

- Mallam Haruna N. Yahaya, mni, Ph.D, FCA, 61st President of the Institute of Chartered Accountants of Nigeria

- Dr. Musibau Lanre Olasunkanmi, FCA, Registrar and Chief Executive of the Institute of Chartered Accountants of Nigeria

- Mr. Jamiu Adeyemi Olakisan, FCA, ICAN Council Member

- Mr. Oduware Uwadiae, Partner, Deloitte West Africa, Business Process Solutions Leader

- Mrs. Grace Fatogbe, Managing Partner, Unioncrest Capital Limited

- Members of the FRC Management Team

With the release of the amended Roadmap and SRG 1 2026, the Financial Reporting Council of Nigeria reinforces its commitment to high-quality sustainability reporting aligned with global best practices and the ISSB standards, while ensuring clarity, consistency, and regulatory certainty for Nigerian entities.

Read more ...

February 19, 2026

FRC SIGNS AGREEMENT TO DEVELOP NATIONAL DIGITAL PLATFORM FOR SUSTAINABILITY REGULATORY REPORTING

The Financial Reporting Council of Nigeria today, Wednesday, February 18, 2026, signed an agreement with SALI Technologies and Regulatory Compliance Readiness Advisors Ltd (RCRA) for the development of a National Digital Platform for Sustainability Regulatory Reporting, marking a significant step in strengthening sustainability oversight and corporate transparency in Nigeria. The signing ceremony took place at the Council’s office in Abuja.

The agreement establishes a framework for the design, deployment, and management of a technology-driven platform that will standardise sustainability reporting across Public Interest Entities and enhance regulatory monitoring and enforcement.

In his welcome address, the Executive Secretary and Chief Executive Officer of the Financial Reporting Council, Dr. Rabiu Olowo, described the agreement as a defining moment in the evolution of corporate reporting in Nigeria. He stated that the event represented a commitment to transparency, accountability, and sustainable economic growth.

He noted that sustainability reporting has become central to capital allocation, governance, and long-term value creation globally. According to him, investors, regulators, lenders, and development partners now demand measurable and credible sustainability disclosures alongside financial performance.

Dr. Olowo stated that the National Digital Platform would position Nigeria within the global movement toward credible and technology-enabled sustainability regulation. He explained that the platform would enable structured sustainability reporting, enhance regulatory monitoring, strengthen enforcement capability, generate actionable analytics, and support assurance activities.

He added that the Council would use the platform to standardise disclosures in alignment with globally recognised frameworks, monitor compliance in real time, identify sectoral risk concentrations, detect inconsistencies, and strengthen data-driven oversight.

The Chief Executive Officer emphasised that the initiative would replace fragmented and manual reporting processes with an integrated digital system designed to improve transparency and efficiency. He described the development as regulatory modernisation in action.

Addressing concerns about smaller businesses, Dr. Olowo stated that the platform would adopt phased and proportionate functionality to accommodate Small and Medium Enterprises. He said simplified reporting pathways would ensure that SMEs are supported in line with their scale and capacity, thereby embedding proportionality and inclusion into the regulatory framework.

The concession agreement outlines the roles of the parties. The Financial Reporting Council will provide regulatory oversight and set reporting standards. SALI Technologies and Regulatory Compliance Readiness Advisors Ltd (RCRA) will provide technical expertise, platform development, implementation support, and operational collaboration under the agreed concession framework.

Dr. Olowo further highlighted the broader economic significance of the initiative. He noted that global capital is increasingly influenced by sustainability metrics and that countries with credible and regulator-backed reporting systems attract stronger investor confidence. He stated that the platform would also generate aggregated national analytics to support evidence-based policymaking, climate risk assessment, and sectoral performance monitoring.

He commended SALI Technologies and Regulatory Compliance Readiness Advisors Ltd (RCRA) for their partnership and stressed that sustained institutional commitment, governance, and data integrity would be critical to the platform’s success.

The Council indicated that implementation activities will commence immediately, with phased deployment planned to ensure readiness of reporting entities and assurance professionals. Further guidance and technical directives will be issued in due course to support onboarding and compliance.

The Financial Reporting Council reaffirmed its commitment to strengthening public confidence in corporate reporting and aligning Nigeria with international best practices while supporting sustainable economic development.

Read more ...

February 16, 2026

FRC RELEASES THE 3RD EDITION OF ITS OFFICIAL NEWSLETTER

The Financial Reporting Council (FRC) of Nigeria is pleased to release the 3rd edition of its biannual Newsletter, the official publication of the FRC. This edition, covering the period from April to December 2025, highlights some of the Council’s most remarkable achievements and initiatives in what has been an outstanding year of progress and impact.

New Editorial Board Member Joins FRC Team

The FRC welcomes Ezinwanne D. Nnoruka (Mrs.) to its Editorial Board, following the retirement of Dr. Iheanyi O. Anyahara from the Council. As Board Secretary/General Counsel & Head of Human Resources, Mrs. Nnoruka brings extensive expertise. Her contributions will advance the Council’s communication and knowledge-sharing efforts.

Global Recognition in Sustainability Reporting

This issue celebrates FRC’s prestigious win of the UNCTAD-ISAR Leadership in Sustainability Reporting Honours, with Nigeria as the only African country recognized. This milestone affirms the Council’s commitment to elevating sustainability and financial reporting standards worldwide.

Leadership Legacy and Key Initiatives

It also honours Dr. Rabiu Olowo’s historic tenure as Chair of UNCTAD-ISAR, where he built a lasting global legacy, alongside his transformative two-year leadership at the FRC. Highlights include integrating standards for Non-Interest Finance in Nigeria, issuing guidance on financial reporting in hyperinflationary economies, and unveiling a phased roadmap for Sustainability Disclosure Standards.

A major highlight is the official launch of the maiden edition of the FRC Journal of Financial Reporting and Corporate Governance, a dedicated platform for thought leadership and research in financial reporting and governance.

Insights from the Technical Suite

The newsletter features thought-provoking articles, including:

- The vital role of actuaries in the financial reporting process.

- Characteristics of an effective board.

- The importance of time management in corporate governance.

These pieces offer actionable insights for corporate leaders, regulators, and stakeholders.

As always, we are proud to serve as the voice of the financial reporting community in Nigeria, showcasing our collective strides toward transparency, accountability, and global best practices. Dive into this edition and join the FRC’s vision for a stronger, more resilient financial reporting framework.

[Download the 3rd Edition of FRC Newsletter]

For more information, contact: newsletter@frcnigeria.gov.ng | Visit www.frcnigeria.gov.ng

Read more ...